Renters Insurance in and around Lakeland

Your renters insurance search is over, Lakeland

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

- polk county

- tampa

- wesley chapel

- brandon

- mulberry

- westchase

- auburndale

- riverview

- plant city

- st. petersburg

- bartow

- valrico

- fishhawk

- apollo beach

- sun city center

- coral springs

- fort lauderdale

- tamarac

- parkland

- orlando

- west palm beach

- boca raton

- sunrise

- macdill afb

Home Is Where Your Heart Is

Home is home even if you are leasing it. And whether it's a condo or an apartment, protection for your personal belongings is beneficial, even if you think you could afford to replace lost or damaged possessions.

Your renters insurance search is over, Lakeland

Rent wisely with insurance from State Farm

Safeguard Your Personal Assets

Many renters don't realize that their landlord's insurance only covers the structure. Your valuables in your rented townhome include a wide variety of things like your cooking set, bed, coffee maker, and more. That's why renters insurance can be such a good decision. But don't worry, State Farm agent Rachel Machin has the efficiency and experience needed to help you understand your coverage options and help you protect yourself from the unexpected.

Contact Rachel Machin's office to see how you can save with State Farm's renters insurance to help keep your valuables protected.

Have More Questions About Renters Insurance?

Call Rachel at (863) 683-5553 or visit our FAQ page.

Simple Insights®

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

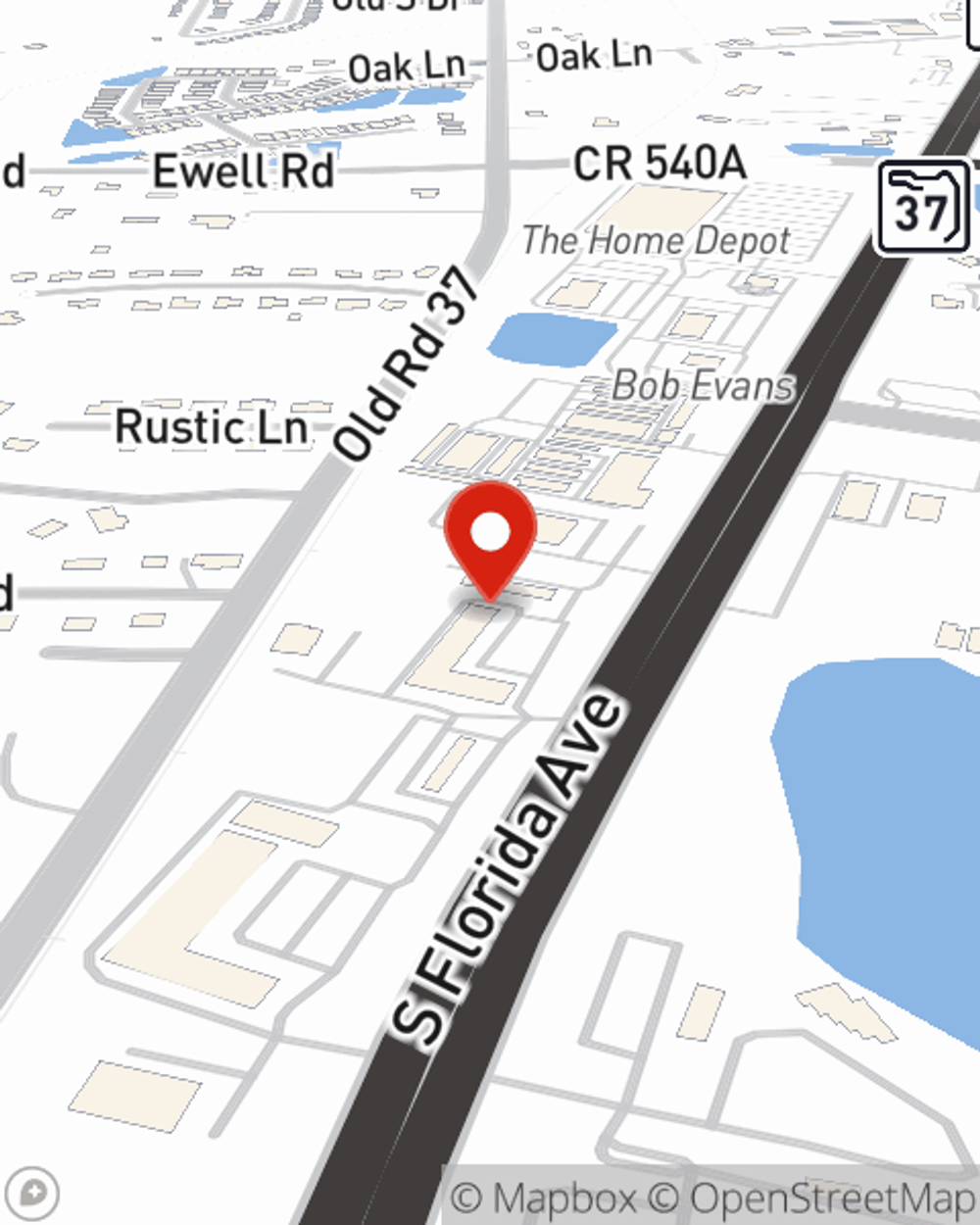

Rachel Machin

State Farm® Insurance AgentSimple Insights®

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.